Fast Contract Execution

Sign customers in the field or office and activate service the same day without delays.

Security and alarm companies have been forced into expensive legacy eVaults or duct-taped DocuSign workarounds. Loyva delivers:

Loyva replaces expensive legacy tools with a single platform built for the security industry. You get eSign, eVault, and compliance without enterprise pricing or surprise fees.

Every contract is encrypted, time-stamped, and stored in a compliant digital vault. Loyva ensures your agreements meet UCC 9-105, ESIGN, and UETA requirements from day one.

Loyva turns signed RMR agreements into finance-ready assets. Banks get the proof they need, and you get faster access to working capital.

Sign customers in the field or office and activate service the same day without delays.

Securely store contracts in a tamper-proof eVault that meets UCC 9-105, ESIGN, and UETA standards.

Turn RMR agreements into bankable digital assets that support funding, securitization, and faster capital access.

Track every action with full audit logs, AES-256 encryption, and two-factor authentication for every user.

Connect to your CRM, monitoring platform, and finance tools to streamline workflows and eliminate manual work.

Replace expensive tools and hidden fees with one purpose-built platform at transparent, scalable pricing.

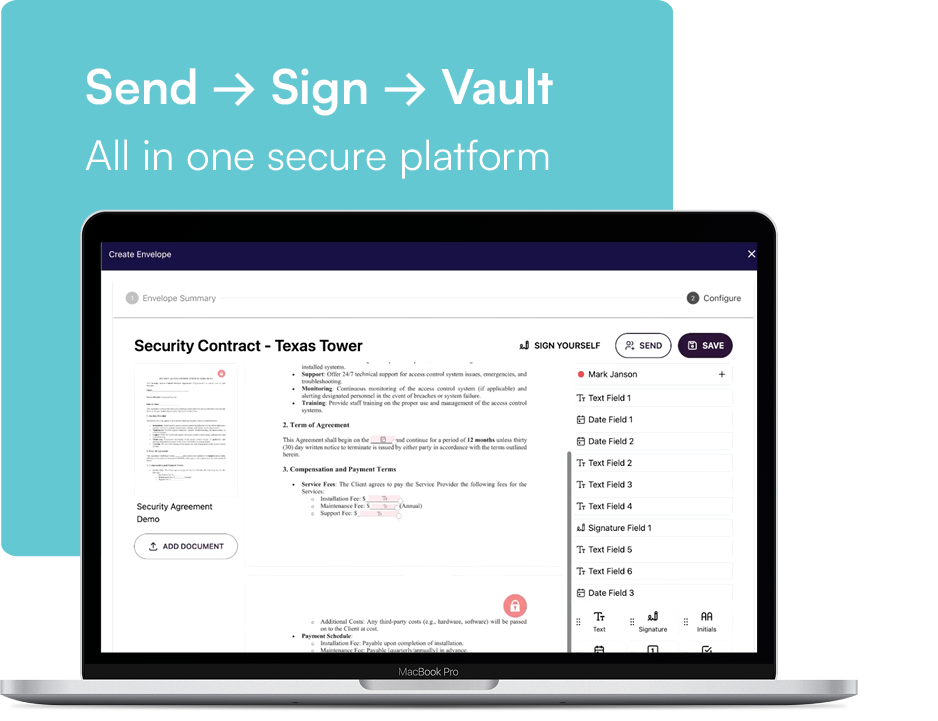

Send: Create and send agreements from the field or the office.

Sign: Capture secure, legally binding eSignatures in seconds.

Vault: Store contracts in a tamper-proof, finance-ready digital vault.

AES-256 encryption in transit and at rest.

with two-factor authentication.

Under UCC-9-105, ESIGN & UETA

Security companies rely on Loyva to automate eSignatures and eVault recurring revenue (RMR) contracts, unlocking capital and accelerating growth. Banks trust Loyva verified digital contracts to secure loans and collateralize assets without losing compliance or integrity.

An eVault is a secure digital repository for legally binding contracts. Unlike basic cloud storage, an eVault ensures tamper proof, compliant storage under regulations like UCC Article 9, ESIGN, and UETA. For security and alarm companies, it is essential for protecting and validating recurring monthly revenue (RMR) agreements, especially when those contracts are used for financing.

DocuSign is built for general use. eOriginal is powerful, but complex and expensive.

Loyva was built specifically for the Security and Alarm industry, combining eSignature and eVaulting in one simple, compliant, and affordable platform. It is everything you need and nothing you do not.

Loyva creates digital, legally enforceable contracts that are securely vaulted and easy for your bank to access. This provides proof of signed agreements and helps accelerate the loan or underwriting process, especially for businesses looking to securitize RMR contracts.

Yes. Loyva meets or exceeds industry compliance standards, including:

UCC Article 9 105 (control of electronic chattel paper)

ESIGN Act and UETA

SOC 2 Type II security standards

AES 256 encryption

Full audit trails and two factor authentication

Loyva serves security and alarm system integrators, monitoring centers, and banks and financial institutions that lend against recurring revenue.

Whether you are just starting to digitize contracts or replacing a legacy platform, Loyva was designed for your workflow.

Yes. Loyva can fully replace DocuSign, eOriginal, OneSpan, or other tools, combining eSignature and eVault in a single, streamlined platform that is compliant, secure, and purpose built.

Most companies are fully operational in just a few days. Our team provides hands on onboarding and will guide you through setup. No IT resources or complicated implementation needed.

Loyva offers transparent, scalable pricing built for small to mid sized security companies. No inflated enterprise rates and no surprise fees. We will walk you through options based on your business needs during your demo.

Yes. Loyva integrates with many CRM systems, monitoring platforms, and financial tools. We will work with your team to streamline your workflow, whether you are using spreadsheets or more advanced tools today.

Loyva gives you full control. You can grant banks secure, read only access to your vaulted contracts, making the funding, verification, and due diligence process faster and more transparent.